Applying a Gender Lens to Agriculture: Farmers, Leaders, and Hidden Influencers in the Rural Economy

In this issue brief, we share how we’ve applied a gender lens to our work in smallholder agricultural finance. Through our Women in Agriculture Initiative, we’re doubling down on our support for women farmers, agro-processing employees, and leaders. This program is fostering economic empowerment and underscoring the vital nature of women in less conspicuous—but high-impact—agricultural roles.

Tziscao aggregates and markets organic- and fair trade–certified coffee from 485 farmers in the southern Mexican state of Chiapas. With this impact study, we seek to understand both the cooperative’s likely impacts on its members and of Root Capital’s impact on the cooperative, with regards to both farmer livelihoods and environmental performance.

The complexity of the coffee rust crisis requires tight integration across government, business, international development and the finance sector. To that end, my organization, Root Capital, has launched the Coffee Farmer Resilience Initiative (CFRI), a multifaceted and collaborative venture that channels investment to coffee farmers at the base of the value chain.

Despite countless tragedies, Colombia's long-conflicted coffee lands have recently transformed in ways that are driving hope, optimism, and improved livelihoods farther into the countryside than ever before. In fact, many farmer cooperatives in the region are confronting and managing through issues like coffee leaf rust disease on their own terms and are leading a veritable revolution in crop quality.

We believe that assessing social and environmental factors is not just a way for mission-driven financial institutions like Root Capital to create impact. In this issue brief, we posit that social and environmental due diligence can also create financial benefits that partially or fully offset the costs involved for lenders and investors.

I sat down with Andrew Stern of Dalberg Advisors to talk about a topic that’s near and dear to my heart—how to spur a financial market to serve the unmet needs of the world’s 450 million poorest farmers while preserving our natural resources.

This case study evaluates how the Nicaraguan coffee cooperative COOMPROCOM supports farmer livelihoods. It assesses the impact of Root Capital lending on clients, and the impact of COOMPROCOM on the smallholder farmers they serve.

Colin Powell once said that “capital is a coward,” and the data shows that foreign private investment generally waits a decade before re-entering post-conflict countries. Yet the world can’t wait that long. This blog post is about capital becoming more courageous in places like Somalia and the Democratic Republic of Congo (DRC), where economic reconstruction can contribute mightily to the transition to peace and security, even in regions still ravaged by war.

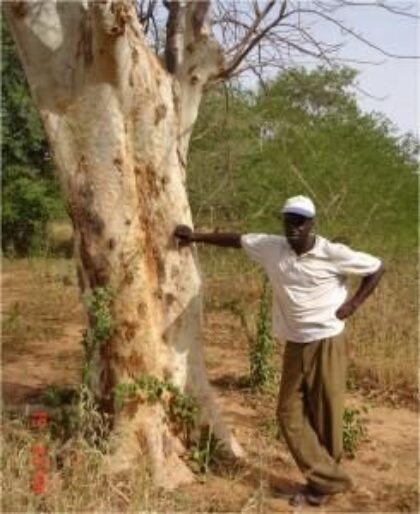

Togolese social entrepreneur Francois Locoh-Donou is at the forefront of efforts to build the capacity for nut processing within West Africa.

Malian business Produits du Sud offers a microcosm for how such small and growing agricultural businesses can foster long-term peace and prosperity in one of the most troubled regions of the world.