While you may not be able to find Matagalpa, Nicaragua on a map, you can taste it in your morning cup of coffee. This region is one of the world’s biggest coffee producers, thanks to the thousands of smallholder farming families who call it home. Individually, these farmers could never get their harvest from their field to your breakfast table. But by joining cooperatives like CIPAE, they can use their collective power to access international markets.

CIPAE, like many agricultural businesses, needs access to financing if it hopes to grow and improve the lives of more farmers. But CIPAE is young—founded in late 2015. Early-stage businesses struggle to find affordable credit that fits their needs. Even for a social lender like Root Capital, these loans can be prohibitively risky and costly to make. Despite the high potential for transformative impact, early-stage businesses like CIPAE are often denied the financing they need to unlock that impact.

In 2019, Root Capital began working with the Swiss Agency for Development and Cooperation (SDC), Roots of Impact, and IDB Lab, the innovation laboratory of the Inter-American Development Bank Group, to deploy a model called Social Impact Incentives (SIINC). Co-created by Roots of Impact and SDC, the SIINC model is an outcomes-based funding instrument that rewards verified social impact. With funding partners like IDB Lab, SIINC solves for the short-term unprofitability of loans to early-stage businesses by incentivizing financial institutions—in this case, Root Capital—to work with this market segment.

With an increasing number of agricultural businesses that offer critical services to small farmers and rural populations, we see the SIINC model as a timely mechanism to reach these enterprises and sector.Alejandro Escobar, Lead Investment & Operations Officer, Inter-American Development Bank

Working together, we’ve leveraged $1 million in outcome payments to provide $11.5 million in loans to 32 businesses across Latin America that couldn’t access comparable financing from commercial sources. In the process, we’ve learned important lessons about deepening impact in rural communities around the world.

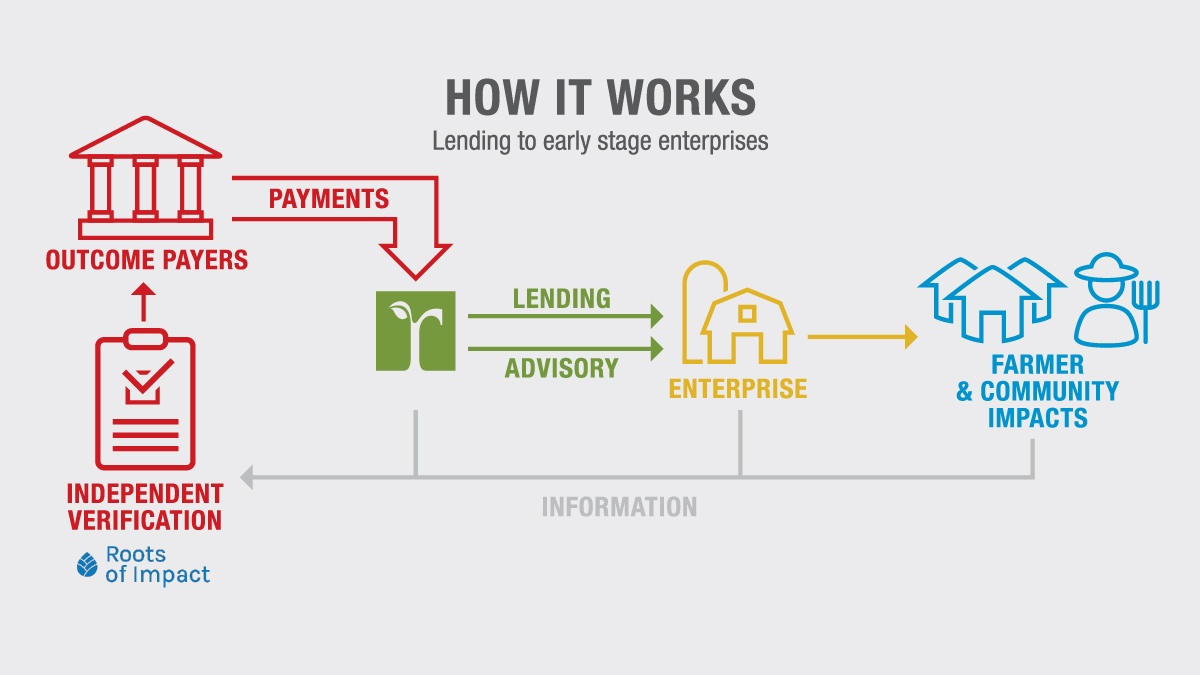

How it works

Under the SIINC model, IDB Lab and SDC make outcome payments to compensate for the additional costs of lending to early-stage businesses like CIPAE. Pulling from Root Capital’s two decades of data and experience in lending to agricultural businesses, we’re able to calculate the extra risk and cost of these loans. This forms the basis for the outcome payment structure, pegging them to predetermined outcome criteria on which all partners are aligned.

Throughout the project, an independent verifier—in this case, Roots of Impact—confirms that each loan Root Capital makes under the project achieves the targeted outcomes, at which point outcome payments to Root Capital are triggered.

Linking finance to verified impact is at the core of what we do, and is strongly reflected in the work of Root Capital.Rory Tews, Lead, Research and Development, Roots of Impact

In the long term, SIINC catalyzes investment in businesses that lack financing but are poised to grow. Eventually, these businesses’ growth will enable them to become profitable, making the incentive payment no longer necessary.

Photo of a Root Capital financial advisory training at an early-stage coffee business in Nicaragua. Our longstanding advising relationships with clients like these gave us a headstart when reorienting our lending in the region through SIINC.

Operationalizing SIINC – a more straightforward approach to outcomes-based financing

Operationalizing an innovative model such as SIINC required important adjustments to our internal lending processes. While SIINC is a relatively simple approach to outcomes-based financing (and thus lower-cost than other, more complex, models), reorienting our lending program required upfront investments in staff training, policy updates, and the impact verification process. It also required a stronger level of coordination with IDB Lab and SDC to agree upon all the parameters and outcomes—including how we’d measure them.

First, we needed to expand our lending pipeline—which had been oriented to organizations with more established track records and larger credit needs—to identify and serve less mature businesses. Through our advisory services program, Root Capital has been building the financial management capacity of earlier-stage businesses for years; and we leaned on these relationships to create a suitable pipeline.

Even more fundamentally, our team needed to adjust how we evaluate and approve loans. We conducted an internal deep-dive training on the project’s criteria and rigorous verification process. Our loan officers were energized by the ability to provide financing that balances risks with maximal impact for rural communities.

Impact of the project

Over the course of the project, SIINC has had a measurable impact on Root Capital’s lending, our client businesses, and their smallholder farmer-members:

- Root Capital more than doubled the percentage of loans in its portfolio that met credit needs unaddressed by other funders compared to its pre-SIINC portfolio in the target countries.

- Businesses receiving SIINC loans used $11.5 million of credit to generate $48 million of revenue, $41 million of which they paid directly to smallholder farmers.

- With the complementary support of technical assistance and training funded by IDB Lab, 56% of clients grew their annual revenues in just 18 months, with an average growth rate of 41%.

- The 32 businesses receiving SIINC loans paid, on average, $4,391 per farmer for their crops with the project reaching a total of about 9,000 farmers.

Building on our success to support businesses through COVID-19

The initial results from SIINC are encouraging, but the challenges facing these early-stage businesses don’t end after receiving a first or second loan. As COVID-19 threatens small and growing businesses around the world, early-stage businesses without a financial safety net are particularly vulnerable. To ensure continued success for these businesses, we recently launched the next iteration of the SIINC partnership.

Over the next two years, Root Capital will leverage up to $750,000 in SIINC outcome payments to provide an estimated $6 million in loans to 25 early-stage businesses in Latin America. In this next phase, funding from IDB Lab and SDC will also support resilience grants and critical advisory services to help these businesses manage their operations through the pandemic. And, with reserved loan loss support, we’ll be situated to responsibly expand our risk appetite and make loans to even earlier-stage—and higher-impact—businesses in rural communities.

The COVID crisis made us very concerned about the achievements of the first round. What if existing cooperatives stop growing, go backwards, or even go out of business? We have to continue the collaboration while accommodating for now even higher risks and costs.Peter Beez, Senior Policy Advisor, Swiss Agency for Development and Cooperation

Closing the persistent financing gap for agricultural businesses can help address some of the most fundamental challenges of our day, from poverty to climate change. Across the sector, others have begun to adopt similar incentive models. For example, the Council on Smallholder Agricultural Finance (of which Root Capital is a founding member) launched Aceli Africa with a SIINC-like incentive scheme to increase lending to the least-served segments of agribusinesses in Africa, working alongside SDC and Roots of Impact. As more innovative financing mechanisms come to market, we must share successes and challenges across sectors to ultimately build a more inclusive financial market.

As for CIPAE, with the support of SIINC, the cooperative grew its financing from a $150,000 loan in 2019 to $400,000 in 2020 and its farmer membership swelled by 33% in just one year. Now, as the pandemic threatens their progress, Root Capital and our partners through SIINC stand ready to build resilience and impact for generations of farmers of Matagalpa.

Photos © Sean Hawkey and Root Capital