Gender lens investing is an increasingly popular approach for impact-focused investors. In just the last few years, the number of firms investing with a gender lens has exploded, and these firms have gone from raising $1.1 billion in capital in 2017 to $4.8 billion in 2019. On top of that, the global 2X Challenge recently announced it would raise $15 billion for gender lens investing after securing more than double its original $3 billion target.

This is great news, especially since the gender financing gap remains huge-$320 billion just for women entrepreneurs in low- to middle-income countries. By embedding gender-focused outcomes into their strategies and decision making, investors can have a positive impact on women and girls while generating financial returns for their portfolios. But many investors don’t know where to start.

How Root Capital Embedded Gender Inclusion In Our Work

Root Capital established the Women in Agriculture Initiative (WAI) in 2012 to help identify and address the systemic inequities rural women face. Since then, the WAI has grown from a set of discrete activities to an organization-wide strategy that’s core to our work.

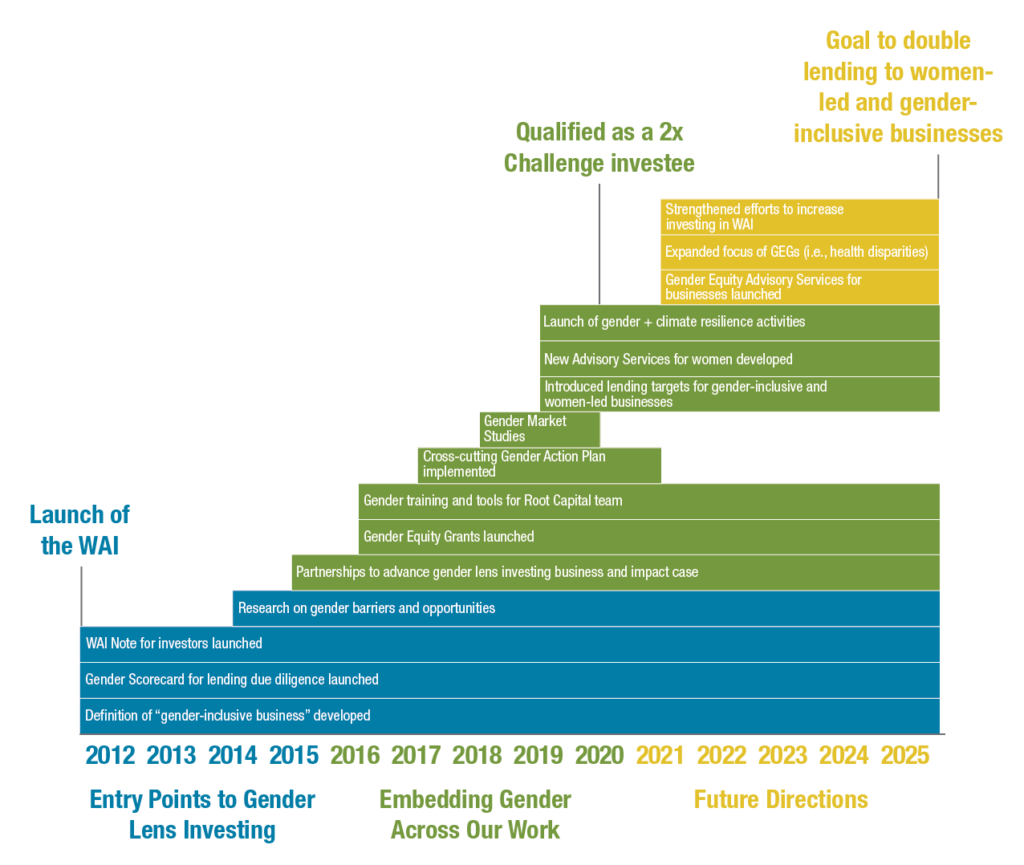

Our journey into gender lens investing has gone through distinct phases. First, from 2012 to about 2015, we concentrated on specific “entry points,” including:

- Defining and tracking gender-inclusive businesses;

- Launching a Gender Scorecard to incorporate gender-related metrics into our lending due diligence;

- Launching a specific WAI note for our investors; and

- Measuring gender-related barriers and impacts through field-based studies.

We learned from those efforts, and from 2015 to 2020, further embedded gender across our work, both internally and externally. During this period, our main activities were:

- Piloting Gender Equity Grants (GEGs) to help our client agricultural enterprises implement gender inclusion actions;

- Developing a cross-cutting Gender Action Plan to identify concrete gender lens activities across all Root Capital departments;

- Building gender awareness within our global team through a series of internal workshops and trainings;

- Developing partnerships with relevant experts, such as Value for Women, Criterion Institute, G-SEARCH, Gender Smart, and more.

- Adapting our advisory curriculum to women’s unique roles, needs, and challenges; and

- Conducting market studies to identify new women-led and gender-inclusive businesses that could benefit from Root Capital lending.

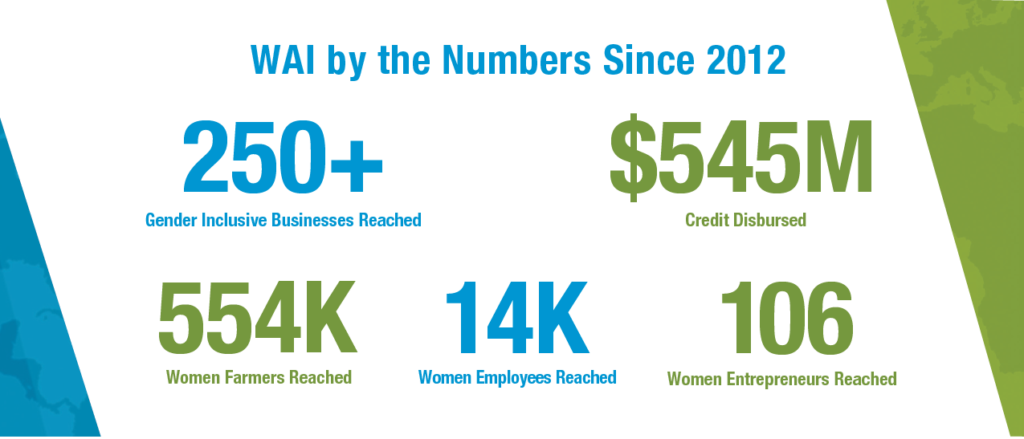

These activities have translated into real impact. To date, Root Capital has invested $545 million in 254 gender-inclusive businesses, including 106 women-led businesses, reaching over 550,000 women producers and over 14,000 women employees. In the coming five years, our ambitious goal is to double our lending to both women-led and gender-inclusive agricultural enterprises.

5 Tips for Budding Gender Lens Investors

Over the last nine years, we’ve learned a lot. Whether you’re just getting started in your gender lens investing journey or looking to further mainstream your approach across your organization, here are five tips:

- Investors who are not gender-first can effectively promote gender equality.

Root Capital identifies first and foremost as an agriculture-focused lender, rather than a gender lender, and its staff, beyond the WAI team, do not consider themselves to be gender experts. But our success demonstrates that an organization with gender equity as one of many goals can successfully apply a gender lens. A lender can also develop its team’s expertise and partner with gender advisors-as Root Capital does with Value for Women-to design new gender-inclusive services, deliver expert gender training, and ultimately increase opportunity for women. - Making a bold and public commitment is a key first step.

For Root Capital, creating and launching the WAI was an important step in mobilizing the organization, as well as our donors and supporters, to take decisive actions. Since the program’s commencement, Root Capital has understood the importance of announcing our commitment both to the team and to the public. This ensures that we are held accountable to our goals and facilitates shared learning that can catalyze others to deepen their commitments to gender lens investing. - Incremental action can be highly impactful.

Between 2012 and 2020, Root Capital made progress step-by-step, expanding the WAI’s reach and programming. This gradual addition of activities gave the organization time to build buy-in, secure needed philanthropic funding, and to demonstrate impact and results that helped to further move the initiative forward. We also knew we couldn’t solve all challenges at once; we identified barriers to our growth and impact as they arose and addressed them head on. - Creating a Gender Action Plan can accelerate progress.

This is especially true if the plan’s creation is highly participatory. In Root Capital’s case, working across each department to identify goals for the short- and long-term, put those goals on paper, and create an actionable plan was instrumental for some of our boldest actions in the past few years (e.g., setting targets for gender-inclusive lending and launching new gender-focused advisory services). - Time allocated to gender training and discussion is time well spent.

Many investors are understandably reluctant to take team members away from their daily responsibilities. However, at Root Capital we’ve found that periodic gender-focused workshops and discussions, both internally and externally facilitated, are highly impactful. Training-along with explicit goals and the resources to execute toward them-has helped the team internalize the rationale for gender lens work and inspired them to dedicate time and creativity to executing WAI activities. This also ripples out to our client agricultural businesses, who are better able to embed gender inclusion in their own operations when guided by our highly trained and committed staff.